Mutual Funds

Because Every Rupee Deserves to Grow.

Smart Investment Trusted Advise Expertz-Led Investment Strategies

At Expertz Fintech solutions, we make mutual fund investing simple , transparent and tailored to your goal. Whether you’re planning for wealth creation, retirement, education, or tax-saving — our team helps you choose the right funds based on your financial profile and risk appetite.

What is Mutual funds?

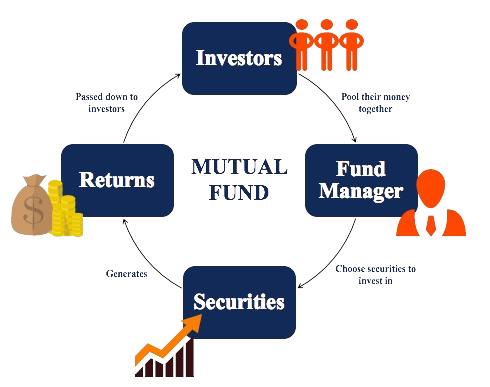

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. These funds are managed by professional fund managers who make strategic investment decisions to maximize returns while managing risk. Practically, one does not invest in a mutual fund but invests through mutual funds. However, we hear of “investing in mutual funds” or “investing in mutual fund schemes”.

By investing in mutual funds, you can benefit from expert management, diversification, and potential growth without needing to monitor stock markets daily. If you want good mutual funds to invest in, research plays a crucial role.

Lumpsum Investment

A lumpsum investment means putting in a big amount of money at once. It works best when you have extra funds and want to grow your wealth over time. If you invest when the market is down, you have a better chance of making higher returns in the future.

Systematic Investment Plan (SIP)

A Systematic Investment Plan (SIP) allows you to invest in mutual funds through small/periodic investments with a fixed amount of money, every month. It is a practical approach that helps you invest in a disciplined manner to achieve your financial goals.

Role of Mutual funds

- We work with top Indian banks & NBFCs

- Transparent process & honest suggestions

- Free consultation before applying

- CIBIL Score check & improvement tips

- Personal assistance until your card is delivered

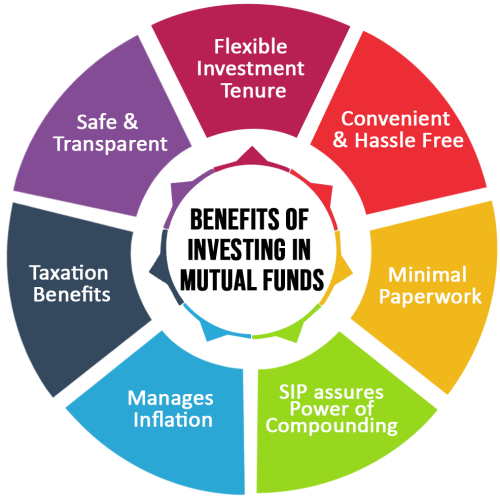

Key Benefits:

Choosing the best mutual fund investment platform can provide multiple benefits, including:

Diversification – Spread risk across multiple assets, reducing overall investment risk.

Professional Management – Managed by top mutual fund advisors who analyze and optimize investments.

Liquidity – Easily redeem your investments whenever needed.

Affordability – Start with as little as ₹500 through an SIP planner.

Tax Benefits – ELSS funds offer tax deductions under Section 80C.

Flexibility – Choose from direct mutual funds, ELSS SIPs, or hybrid funds.

Regulated & Transparent – SEBI ensures investor protection and transparency.