Smart Investing. Trusted Advice. Powered by Expertz Fintech Solutions.

At Expertz Fintech Solutions, we make mutual fund investing simple, transparent, and tailored to your goals. Whether you’re planning for wealth creation, retirement, education, or tax-saving — our team helps you choose the right funds based on your financial profile and risk appetite.

Why Choose Expertz Fintech?

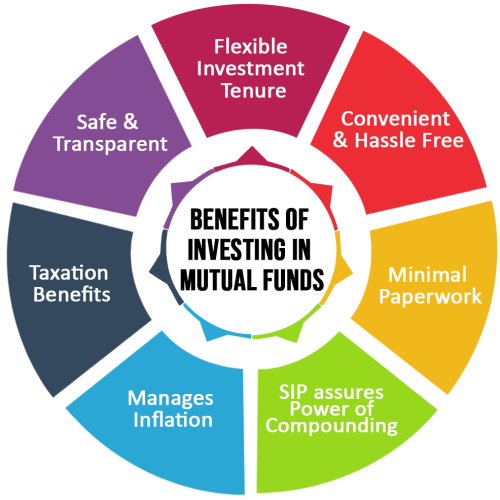

Key Benefits of Mutual Fund Investments:

Frequently Asked Questions (FAQs)

What is a Mutual Fund?

A Mutual Fund is an investment vehicle that collects money from multiple investors and invests it in diversified financial assets like stocks, bonds, or a mix of both. It is managed by professional fund managers.

Is it safe to invest in mutual funds?

Yes, mutual funds are regulated by SEBI (Securities and Exchange Board of India). While they are subject to market risks, proper planning and guidance can help minimize risks and maximize returns.

Can I start investing with a small amount?

Absolutely! You can begin a SIP with as little as ₹500 per month, making it accessible to almost everyone.